JHVEPhoto/iStock Editorial by way of Getty Visuals

Inflation has become a extremely very hot topic in the latest quarters, and readers have no doubt been imagining a whole lot about the variety of stocks that could hold up very well in these kinds of an setting. Broadly speaking I would look for three items: superior revenue margins, low money intensity, and, from an investing perspective, a comparatively high shareholder yield.

Cafe Brands International (RBI) (NYSE:QSR) ticks at minimum a couple of individuals packing containers. The business owns the Burger King, Tim Hortons, Popeyes Louisiana Kitchen area and Firehouse Subs models, with its practically 100% franchised estate affording it large margin revenues and somewhat reduced funds expenditure needs. That’s not to say the company is fully immune from the latest economic local climate it is sensitive to the health and fitness of its franchisees, whose margins will be coming underneath force from cost inflation. On prime of soft underlying performance in its domestic Tim Hortons and Burger King organizations, that could at the very minimum be a headwind to around-expression expansion.

Still, RBI certainly possesses a fantastic underlying business, and although the stock is not surprisingly low-cost, a 17x ahead earnings many appears realistic price specified solid mid-to-long-time period development prospective buyers. Buy.

Higher Margin, Lower Capital Intensity

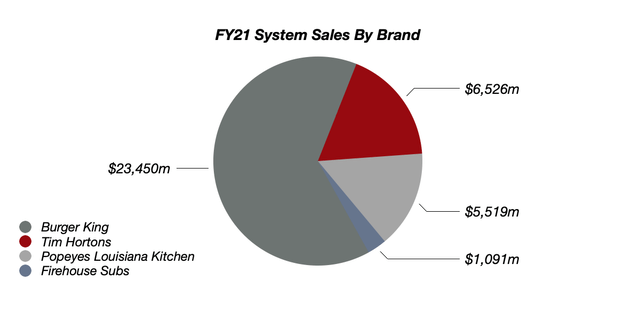

RBI’s world portfolio currently encompasses 29,576 dining places distribute across the Burger King (19,266 places to eat), Tim Hortons (5,320), Popeyes Louisiana Kitchen area (3,771) and Firehouse Subs (1,219) models. Practically all of its restaurants operate under franchise agreements, with business-operated places to eat totaling less than 150 at last count, or just .5% of the complete estate.

Info Resource: Cafe Brand names Worldwide 2021 Annual Report

The organization model is attractively basic: RBI typically gets anywhere in between a 3% to 6% slice of gross weekly income relying on the brand name and jurisdiction, with franchisees also on the hook for a a single-off upfront charge at the begin of their agreements and on renewal. Clearly that frees RBI from a good deal of the day-to-day costs of jogging a cafe, even though shops that are leased or subleased from RBI are accomplished on a “triple internet” basis, meaning that tenants are on the hook for all of the expenditures related with the true estate.

For Tim Hortons North American operations, the business is also in the producing, supply and distribution business enterprise, albeit the economics of the franchised estate however result in robust enterprise-vast degrees of profitability and free of charge income move.

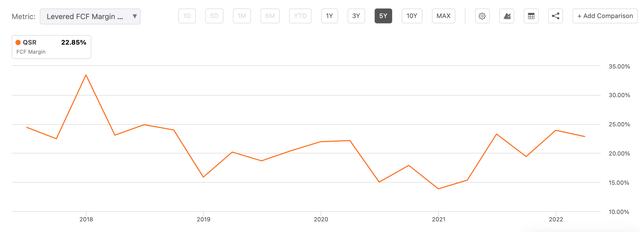

Supply: Trying to get Alpha

Challenges Continue to Ahead

Whilst RBI is positioned at a far more financially rewarding place of the price chain, it is of course continue to delicate to what is actually happening at the cafe stage. Which is in the long run what drives demand for its franchise agreements following all.

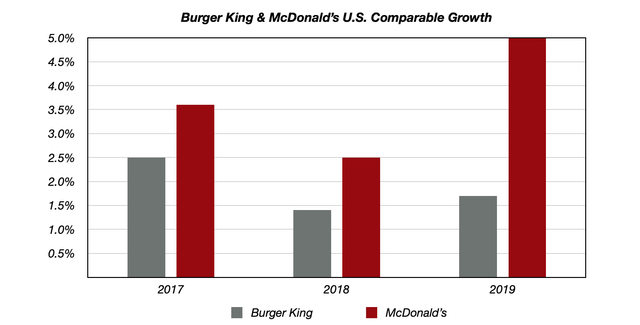

With that, issues have been a little bit of a mixed bag right here, with RBI’s two major brand names, Burger King and Tim Hortons, getting struggled a bit in their domestic marketplaces, the United States and Canada respectively. At Burger King, domestic equivalent income growth has been quite tender, clocking in at 2.5%, 1.4% and 1.7% in the three years proceeding COVID (to strip out the sound from the pandemic). Just by way of comparison, McDonald’s (MCD) – Burger King’s most evident direct competitor in the hamburger space – noticed domestic comparable gross sales progress regular close to 180bps larger about the similar time period.

Facts Resource: Restaurant Models International & McDonald’s Company Annual Stories

That underperformance has continued subsequent the COVID-associated upheaval in 2020. Very last calendar year, Burger King place in U.S. equivalent profits advancement of 4.7%, effectively beneath McDonald’s (+13.8%) and other hamburger-peer Wendy’s (WEN) (+9.2%). Q1’22 was also relatively subdued, with Burger King’s U.S. comparable income flat year-on-12 months as opposed to 3.5% for McDonald’s and 1.1% for Wendy’s. Tim Hortons pre-COVID domestic comps have been similarly sluggish, clocking in at .2% (2017), .6% (2018) and -1.4% (2019) respectively.

Soft domestic functionality apart, inflation is also going to show a problem listed here, at the very least indirectly. RBI’s payment-primarily based earnings stream of course shields it to a big extent compared to enterprise-operated firms, but it really is even now heading to show up at the restaurant degree and consequently with broader franchisee overall health.

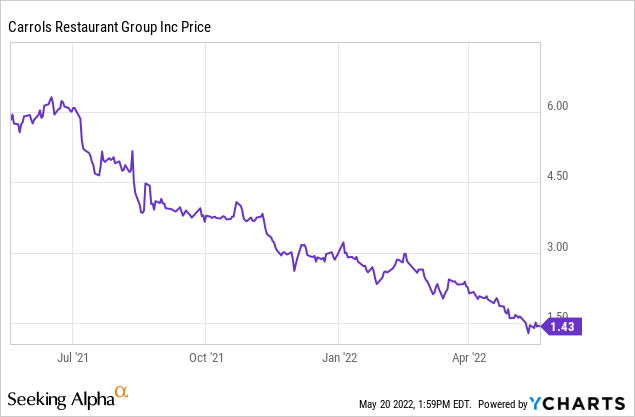

For some proof of the higher than, appear at Carrols (TAST). Carrols is a huge franchisee, working just beneath 1,100 RBI dining establishments in whole (the wide greater part of which are Burger Kings). Its inventory has been smoked a short while ago, falling about 75% this past year as cafe-stage profitability has been hurt by larger costs and contracting margins (altered restaurant-amount EBIDTA fell 40% calendar year-on-calendar year in Q1).

Even though RBI’s earnings stream is mainly cost-linked, weakening cafe-level economics does counsel that advancement may possibly confirm sluggish in the near expression.

Searching At Cafe Depend To Propel Lengthy-Expression Development

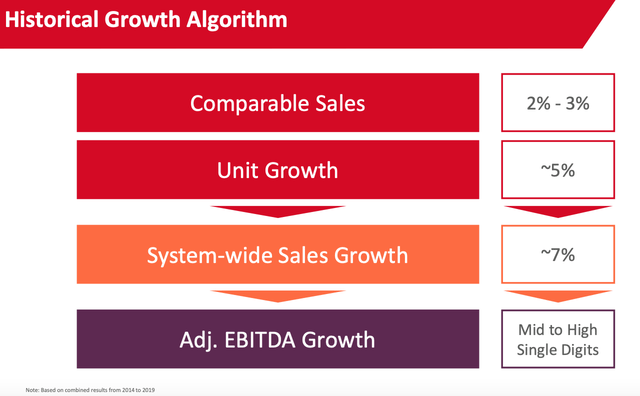

As I stated higher than, RBI is a fairly clear-cut company. Its earnings stream is connected to the technique product sales generated across its models, which can finally expand by means of increased restaurant sales and/or by bringing much more cafe units into the technique. In phrases of the former, Burger King and Tim Hortons have had their domestic concerns, albeit much better general performance overseas and a lot quicker expanding Popeyes have assisted push far better general firm-extensive efficiency. Around the mid-to-prolonged operate I expect minimal single-digit annualized comparable sales development, in line with historic levels.

The more substantial driver for development is likely to be restaurant depend. Pre-COVID, administration was targeting close to 40,000 worldwide places to eat by 2027-2029. Contact it an annualized progress charge in the 5% region. Combined with small one-digits from equivalent income progress, that would tentatively be very good for general expansion in 7% per annum spot.

Source: Cafe Brand names Worldwide 2019 Trader Day Presentation

Cafe rely progress significantly stalled through 2020, understandable specified what was likely on in the wider world at the time, even though new functions and their affect on enter charge inflation could equally delay the development tale. Q1’22 web cafe advancement was strong, rising 4.4% yr-on-calendar year, even though I believe enlargement could be at possibility in the in close proximity to phrase as franchisees wrestle with their current corporations.

Although the over is a slight lead to for problem, it is not like RBI stock is all that pricey, trading at circa 17x and 15x FY22 and FY23 EPS estimates respectively. Discounting long-expression high-single-digit for every annum totally free hard cash movement development will get me to a reasonable benefit in the $55-$60 for each share area, suggesting some upside from the present-day sub-$50 estimate, while the $.54 for every share quarterly dividend is presently good for an appealing-seeking generate of 4.3%. Acquire.